It is always complicated to choose an insurance policy, since we may not know what differentiates one from another. Today we will try to help by giving some keys to choose our funeral insurance correctly.

The type of premium in funeral insurance

One of the peculiarities of this policy is that we are going to keep it for a very long time. Therefore, we should be concerned not only about what we pay now, but also about what it will cost us in the future.

We talked about the types of funeral insurance at length in the most visited article on our website.

There we explained the differences between:

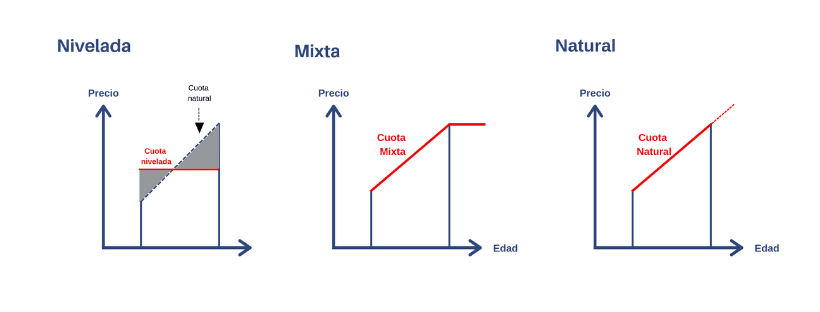

- Natural premium: annually increases in price due to age and the sum insured.

- Mixed premium: similar to the natural premium, but upon reaching approximately retirement age, it is leveled.

- Level premium: increases the price only for the service value.

Contrasting capital appreciation and premiums

Contrasting capital appreciation and premiums

The revaluation of the insured service capital is important, as is the evolution of the premiums paid.

The service capital is the cost limit that the insurance company will assume to pay for the funeral service. It may vary between insurers, but in principle it should be sufficient to cover all the services offered.

How premiums vary is linked to the previous point explained above, and that companies in their projects must show this evolution over the years.

Experience of the insurance company in the sector

More and more insurance companies are offering death insurance policies. However, in this insurance, experience is important.

As it is a service policy, we recommend taking out funeral insurance with an experienced company.

The only exception to this is that a main reason for taking out the policy is the guarantees and services that accompany the policy, as we will now see.

Complementary coverages of funeral insurance

Increasingly widespread are the guarantees that accompany the main funeral service guarantee.

As a way of adding value, insurers are trying to “package” funeral insurance with services and guarantees to be enjoyed during life:

- Toll-free telephone number for medical consultations

- Online Will

- Free mouth cleaning

- Travel assistance

These are just a few examples.

International transfers and repatriations

If we do not want to have problems, we must verify that our insurance covers not only national but also international transportation.

Similarly, if one of the family members goes to live abroad, even temporarily, we must let the company know. In this way, it can be covered by clause.

PIB Group Iberia has been working for a long time in funeral insurance, and we work with the leading companies in this type of policies. From Santalucía, Mapfre, DKV, Preventiva…

Do not hesitate, and count on the advice of our brokerage to find the peace of mind you are looking for.