The Inheritance and Gift Tax (ISD) is a tax that is levied on inheritances and donations, making the beneficiaries of such inheritances and donations taxable. We will see how life insurance is becoming widespread as a mechanism to be able to pay this tax.

Inheritance tax in Spain

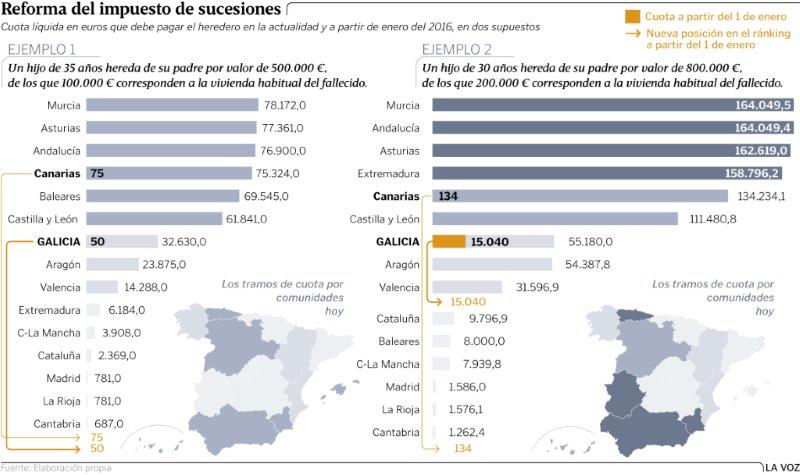

The ISD is delegated to the Autonomous Communities, so it is not the same throughout Spain as VAT, for example. This fact causes great differences between regions when it comes to its liquidation, which is a clear social injustice.

Aragón, the region where we are geographically located, is one of the Communities where this tax is the most burdensome. Despite the fact that other Communities have multiple exemptions (even some are in the process of eliminating it, such as Andalusia), Aragon has confirmed that it will maintain it under similar conditions for 2018.

As we say:

- In some Autonomous Communities, as is the case of Madrid, Cantabria or La Rioja, the ISD is almost totally exempt: Madrid, Cantabria or La Rioja, ISD is practically exempt in its entirety, in others .

- depending on the degree of kinship, age or pre-existing assets of the heir, more than 20% of the value of the inheritance or donation could be paid in taxes.

This causes that in the most extreme cases the heirs may be forced to renounce to the inheritance, which by right corresponds to them.

This graph is more than enlightening (source, La Voz de Galicia):

Financial liquidity through life insurance

We talked about how life insurance can benefit in the event of an inheritance. Precisely, these are the reasons for it: an inheritance in which there is no liquidity to pay the tax can cause

- Having to dispose of assets quickly and, above all, at below their real value, in order to be able to inherit

- Even having to renounce an inheritance because of inability to pay the taxes generated by it.

What this life insurance policy achieves is that the persons who appear as beneficiaries of the insured capital can:

- Quickly receive life insurance proceeds

- To make the “partial” liquidation of the Inheritance Tax (only for the part corresponding to the capital received for the insurance).

In this way,

With the insurance proceeds, we can have enough cash in our account to pay the rest of the tax.

We have already explained the best life insurance policies, which Register to go to in order to find out if a deceased person had a life insurance policy in his or her name and how to collect a life insurance policy.

Example of life insurance proceeds to pay an inheritance

If we inherit 1 million euros between main home, maybe secondary home and cash and savings. It is possible that we will have to pay close to 200,000 € to be able to inherit. If the deceased had a life insurance of, say, 150,000 €, the operation would be:

- Inherit the €150,000 first from the life insurance, and be taxed (let’s say also upwards) at 20%. We would receive in this case, 120,000 €.

- With this, and some savings or even a smaller loan, we could pay those 200,000 € of taxes without any problems.

As we can see, the role of the life insurance policy in these cases becomes fundamental, since seeking financing of €200,000 or more may not be easy depending on our circumstances.

But that is not all. What many people do not know is that the Insurance Company itself has the legal capacity to make an advance of this amount necessary to make the partial liquidation of the tax, in such a way that the beneficiary of the insurance would not have to assume any loss of his economic capacity available at that moment.

If you are interested in further information, do not hesitate to contact us. In Seguros Moné we work with companies specialized in life insurance, which offer us the best conditions in the market and, above all, which have the necessary solvency so that, when we need to have the money for the life insurance, the payment is made as quickly as possible for the reasons we have seen.

If you want to quote your policy with our life insurance comparator, for you or yours, you will be able to choose among the best insurance companies in Spain.