Living from day to day” is something very “Spanish“. We are used to seeing that those who retire receive pensions similar to what they received while they were working. Today we will see the reasons that should lead us to save, always within our means.

Do you really believe that current pensions are sustainable?

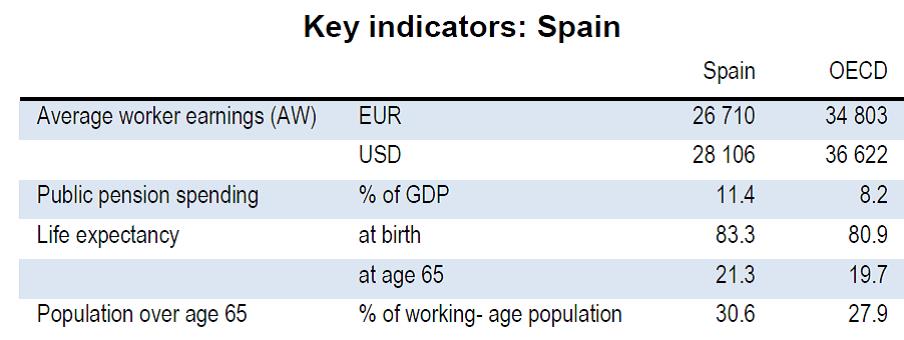

We leave you some data that reflect the difficulty of Spain to pay its pensions in comparison with other countries worldwide. These are statistical data that compare Spain with the OECD (an organization that groups 35 countries, most of them better placed than Spain), and the source of this data is Pensions at a glance 2017:

These data reflect that:

- Spain spends 3% of GDP (in the image “GDP”) more on average to pay pensions.

- Incomes in Spain are below average (where it says “earnings”).

- Life expectancy in Spain is two years above the average (higher pension costs).

- The over 65s in Spain have more weight than the OECD average (more cost to assume in pensions).

If we add to all these data these two:

- The pension fund is depleting, being consumed at a speed that in two years there will be no more pensions in the future.

- Very important: the replacement rate in Spain is around 80%, while in the European Union it is 60%. This compares the last salary versus what we received with our first pension. Perhaps now we understand why in Spain we spend 3.2% more of the GDP on pensions… because we have too high a replacement rate to be able to pay for it.

It is clear that this type of data is behind the talk of not being able to pay pensions.

The sooner you save, the more your money will increase exponentially.

This, which does not seem to make sense, is called the “snowball snowball effect”..

Let’s say that, from your monthly savings of 200 euros, you dedicate 50 euros for your retirement, which means that in 1 year you have 600 euros for that purpose.

Those 600 euros generate a return in one year, let’s say 25 euros. Those 25 euros the following year will continue to yield, accumulating to the 600 euros that you have already put in plus the 600 euros of that year…

This generates a “compound interest which will result in a much higher return 30 years down the road than if you start saving at age 57, when you only have 10 years to go before retirement.

The money in your checking account is an annual financial loss.

As we have pointed out on several occasions, although it may seem strange:

if I save but leave the money in my checking account, I will be losing purchasing power as long as there is inflation, since that money does not produce a return for me and, meanwhile, everything goes up in price.

Most years; there is inflation (in 2017: something above 1%).

Thus, if I left 1,000 euros a year in my account, I would lose 10 euros a year, assuming an average of 1% inflation (although in reality, many commodities rise above that figure). On the other hand, by putting them in a savings product, I could get 30 euros a year, or even more. That is, a difference of 40 euros per year, according to the data in the example.

Be careful! All this is not for us to say…this is something that Spaniards already know. Thanks to the V Survey of Retirement and Saving Habits conducted by BBVA, we know that:

- 81% of those surveyed would recommend saving for retirement (which they justify by the worrying state of Social Security).

- but only 27% of them do so.

If you think it’s time to do it, or that you should at least start looking at a savings product that gives you a good return, contact us and you can compare in one place more than ten financial institutions, to make your search much easier. Find the best PIAS savings plan now.