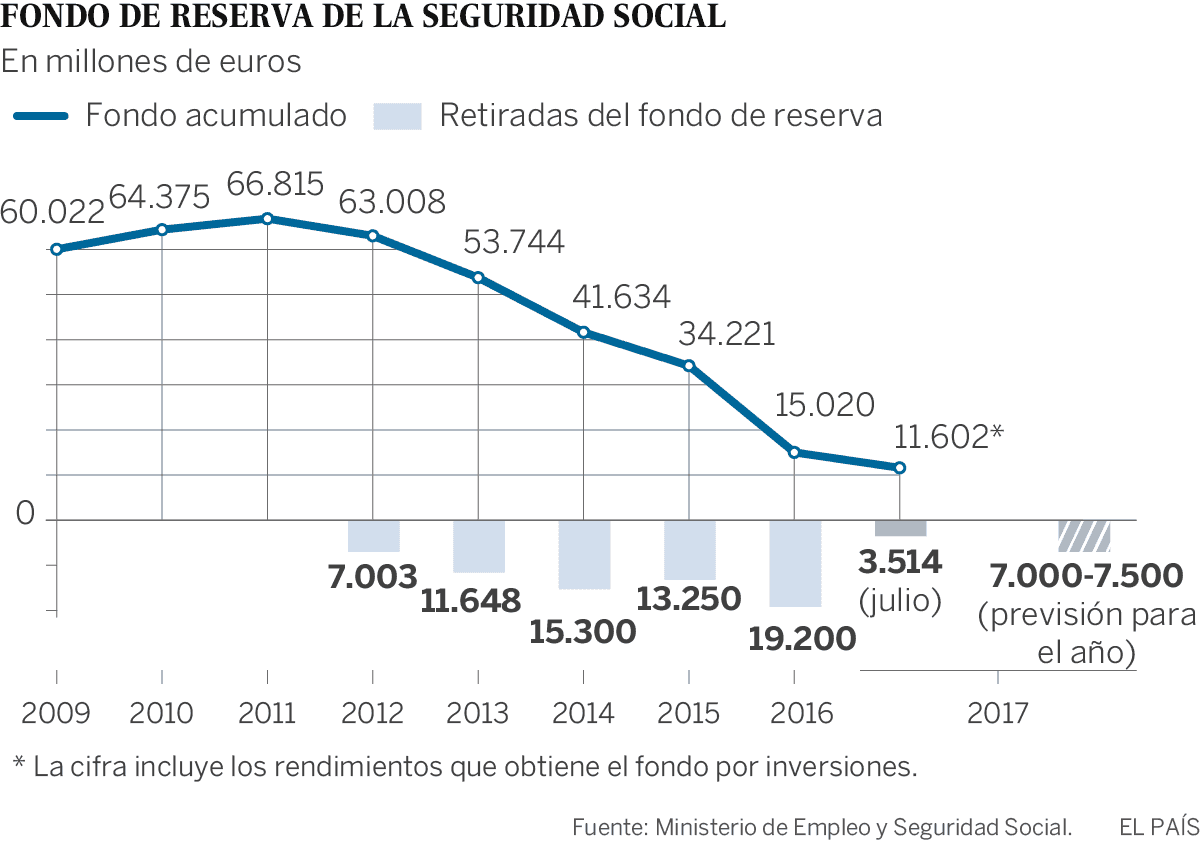

Year after year we have seen successive drawdowns from the Social Security Reserve Fund (the so-called “ Pension Piggy Bank”). “Pension Piggy Bank”).). A few days ago, a new withdrawal was made to pay the July bonus. The main problem is that it has been the largest drawdown since the creation of this Fund: 8,700 million euros, leaving it “shivering”. Let’s see it in figures.

Current situation of Social Security

We have already reported on this situation in previous articles we have published, for example:

- In which we disagreed with the reforms: we described how the Spanish pension system worked and what type of reforms had been carried out recently; or

- The one in which we reflected young people’s concern about their pensions: we offered certain data from surveys conducted, and offered advice on how to start building up personal savings.

Indeed, the situation is not at all promising for current workers and future pensioners. This graph is very illustrative of the provisions made and the remaining balance of the Reserve Fund, which suggests that it may soon be exhausted. The problem is what to do when that happens:

Worrying figures and prospects

Worrying figures and prospects

As we can see, only 25,716 million euros remain, a far cry from the 66,815 million euros accumulated years ago. In other words, it has been reduced by 41,639 million, leaving only 37% with respect to the maximum of 2011.

(Updated data: at the beginning of 2018, the remaining balance in the reserve fund is about €8 billion).

The problem is aggravated, considering that in July of last year only 3.75 billion were used and this year more than double…

Retirement of the baby-boom generation

The greatest nervousness comes from the generation that is yet to reach (or is reaching) retirement.

That generation of parents who were born in the 1950s (the “baby-boom” generation), and who have had high salaries. Therefore, it is expected that their pension will also correspond to that standard of living.

This, in short, means an increase in the cost of the total pension bill.

Quotes from “millenials” (young people)

At the same time, young people between 25-35 years of age are the ones who must replace this mass of the population. Unfortunately, many of them are unemployed or in precarious, poorly paid jobs.

Their contributions also do not match the needs of the system to compensate for the payments to be made, and this is generating widespread nervousness about the future of our pensions.

Solutions to improve pensions

The only way to turn this situation around is to generate more employment. However, the jobs that are being created recently are precarious, as the figures show: Social Security enrollment is increasing by 2.8% per year, while Social Security contributions are rising by only 1.9%.

There are formulas being proposed to reverse this situation, such as: a solidarity tax, as proposed by the PSOE, or eliminating bonuses for companies and the self-employed in Social Security. All these measures are frowned upon by the public.

No solution seems easy, and we Spaniards should plan our retirement, with the aim of generating savings that can compensate for the future drop in the public pension, which is a reality that we will face in a few years.

Our Savings and Investment Department can help you in this process, and advise you on which are the most suitable products to not only get an interesting balance to complement the public pension, but also to do it in a way that fiscally obtains a number of advantages. If this is what you want, contact us and choose the best savings product for you.