The title of this entry may seem far-fetched, however, we believe it is important to raise awareness of the very serious problem we are facing or, rather, that we are facing and must solve. We will give specific figures for the Social Security Reserve Fundand the provisions made to date.

Current situation of the Social Security deficit

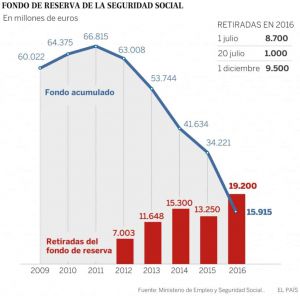

Since 2011 we have been suffering from a deficit in the Social Security, which is why we have been forced to make provisions from the “Pension Piggy Bank”.. That was the year where the Reserve Fund had its record balance: 66,815 million euros. Who would have thought that only 5 years later, we would be in this situation. We check it in this graphic illustrator:

Withdrawals of funds from the Pension Piggy Bank

We can see how, year after year, withdrawals have been increasing over time (except in 2014). The truth is that we are facing a worrying situation, mainly due to the fact that:

- In 2016, €19.2 billion was drawn down.

- The remaining balance of the Reserve Fund before the start of 2017 is less than 16 billion.

The time to pay the extraordinary payments is when it is essential to have those billions available. In this line, as indicated by some political parties, next Christmas there will not be enough money to pay our pensioners the “Christmas bonus”.

Loan is used to pay July bonus (Update 2018)

If we indicated in this original post, which dates back to December 2016, that the payment of the extra payments was getting complicated, the doubts have been confirmed. It has been necessary to resort to a loan granted by the Public Treasury to the Social Security in order to be able to pay the 9’6 million pensions for July.

The point is that the Pension Piggy Bank can no longer be counted on, with only €8 billion left in July 2018.

The question is: “and what happens from now on? In a recent post, we talked about several proposals that are on the Government’s table to try to raise more funds for Social Security. Although, of course, they are no guarantee of success.

It is up to us to prepare ourselves for retirement and supplement the probably insufficient pension that we have left (either via pension plan and/or savings plans). If you want us to help you improve yours, contact us.