The origin of professional cyber insurance is focused on large multinationals, but recently, due to the growing importance of the Internet, these policies have been redirected to small and medium-sized companies ( SMEs).

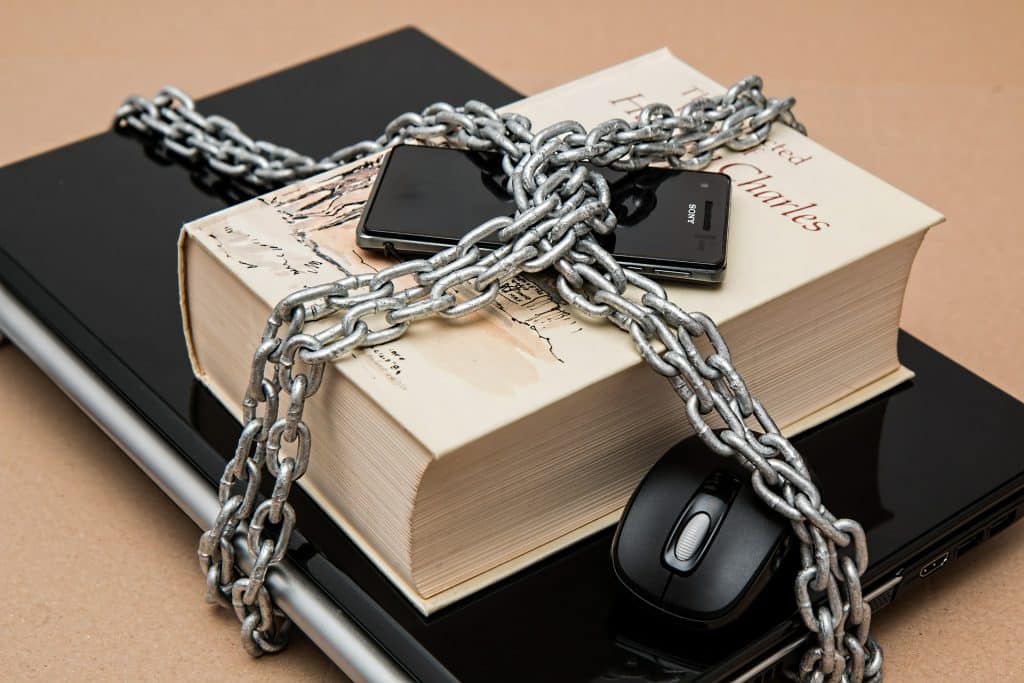

New cyber-risks for SMEs

The Internet and cloud services present new risks and threats.

It could be said that, we know, there is no uncertainty about whether we are going to be digitally attacked in our company. The question is when it will happen and, at that time, whether we will be prepared to counter the intrusion.

Precisely for this reason, the purpose of these insurances is not only to protect us against the attack or to respond to the indemnities for which we are responsible, but also to carry out preventive work, in order to avoid reaching that situation of vulnerability, or to leave it behind. This usefulness of cyber insurance, which is not so highly valued in large companies (due to the usual strength and protection of their own computer systems), is very useful and highly valued in smaller organizations, where systems security is not so well implemented.

Legislation and Data Protection

The legislation, in a progressive manner and, as usual, originating in the USA, aims to protect the individual. In this sense, at the beginning of the 21st century, in the State of California, a law was enacted that obliged companies managing compromised data to report any type of security breach in their systems that could lead to data leakage. This helps to enable rapid detection of the source of the attack or system failure.

Data Protection is one of the most important aspects of computer system protection, since our identity, bank accounts, passwords, medical history and other types of compromised information are accessible via the Internet.

Importing cyber insurance

As has always been the case in the insurance world, in Spain we are implementing systems that have already achieved good results in the United States and the United Kingdom. The advance of cyber insurance has been slower than expected, but it is already known that in the near future it will acquire a relevance that is here to stay.

In part II of this topic, we will go into detail to assess the guarantees of cyber-risk insurance for SMEs, which can be offered in these products. If you have any questions or need information on business insurance, please contact us.