Figures have come to light that reflect the economic difference between men’s and women’s pensions in Spain (which is also generalized in the European Union). There are several reasons that have led to this, and today we want to expose them, offering the real data.

Reasons leading to the difference in pensions received

Indeed, men receive retirement pensions that are much higher on average than those received by women. This gender difference is due to three specific issues:

- The gender pay gap is a latent reality in our society, and although it is slowly being corrected, it is still very present in the Spanish and European labor market (according to the European Commission, the average is 20% for the same type of position).

- Professional careers also differ greatly in their duration, if we distinguish between women and men. The incorporation of women into the labor market has been late and, although nowadays women are joining the labor market at the same time, retired women are doing so with far fewer years of contributions behind them, compared to men. This has a major impact on the pension, considering that more than 35 years of contributions are required to receive 100%.

- The number of hours worked per week is also not the same. This, although not completely, justifies part of the salary difference mentioned above. Since the retirement pension is directly linked to the volume of contributions, a lower salary leads to a lower pension.

The data we are concerned about

We would like to provide a series of data that fully illustrate this problem:

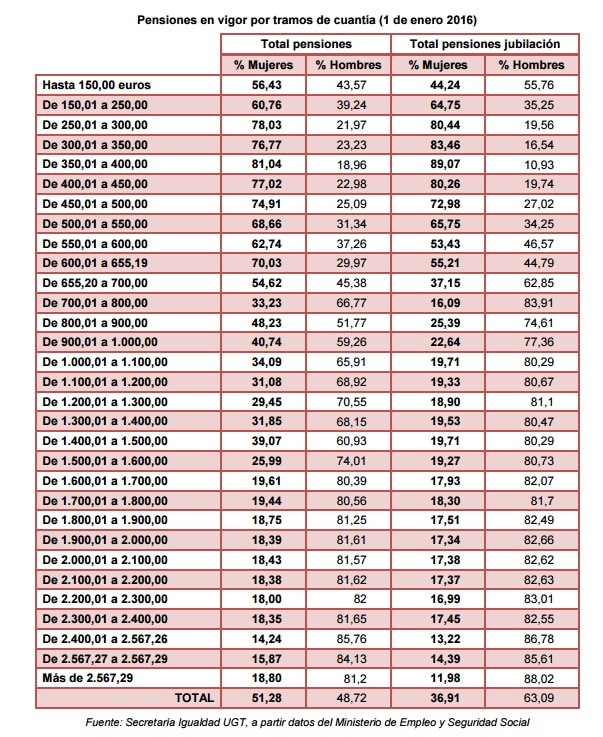

- Although more than 51% of the pensions granted are for women, less than 37% of them are retirement pensions. In other words, most of them are for widowhood, orphanhood, etc., which are usually lower in amount.

- Women account for more than 80% of pensions between 350 and 400 euros, while only 19% of pensions over 2,500 euros correspond to them.

- The average pension for women is 765 euros, while the average pension for men is over 1,200 euros.

Here is the complete data, according to pay bracket, with the percentages between women and men:

How to improve our pensions

As is well known, the pensions currently enjoyed are very difficult to maintain in the medium term, given the difficult situation of the Social Security system.

For this reason, we must consider how we can increase our income once we retire. The answer is only one: by saving now. The real question is through which products I can do it. There are several:

- Pension plans: tax deductible for our contributions but penalized on redemption

- PIAS: tax advantage on redemption as annuities

- SIALP: its tax improvement is in the form of capital redemption

- Other products: there are alternatives linked to investment funds or with higher risk than guaranteed options.

If you want, we can help you improve your pension with a pension plan. Our Savings and Investment Department can do it, and we will be happy to listen to you first, and then to offer you the solutions that best suit you.