Recently, we read a very interesting article in the newspaper El Mundo, in which they highlighted various data on the growth of Social Security expenditure, which we are now presenting. The data reflect the difficult process in which we find ourselves regarding the sustainability of the pension system in our Welfare State.

The social security deficit in figures

To start with a bang: 735 million euros per month is the current deficit of the Social Security. For those less knowledgeable on the subject: this means that every month, the disbursement in the different pensions that Social Security has to face (retirement, widowhood, orphanhood, disability…) far exceeds the income it receives through the contributions of the active population.

The figure is detonating. And it is not a random figure, but has been obtained by the Intervención General de la Administración del Estado (IGAE).

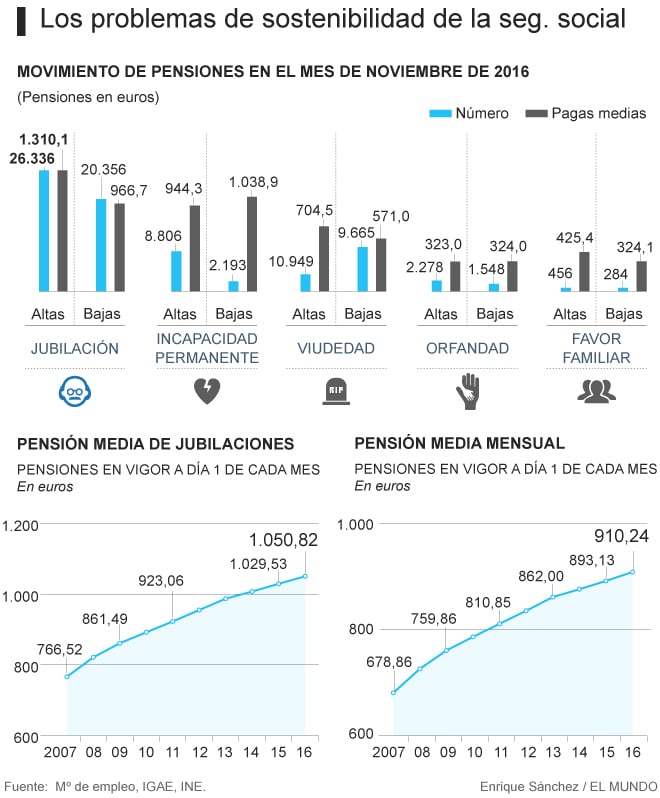

Let’s take a look at this chart and then draw conclusions:

Reasons that lead us to this crisis

The most common pension is the retirement pension. Assuming that these data are the same every month, this means that every month there are 6,000 more retirees to whom a pension has to be paid. This in itself is already worrying, but it is even more so if we take into consideration that this pension is on average almost €350 higher than those of retirees who retire because they have died.

In somewhat more contained figures, but this trend occurs in the other types of pensions: there are more high than low pensions and, as a general rule, these benefits are higher than the old ones.

In addition, these new discharges will last longer than before, as life expectancy continues to increase.

Employment data do not help SS.SS. deficit

Finally, employment data are not good enough to sustain these higher system costs thanks to workers’ contributions. If the average net salary, according to data from the Ministry of Employment, only grew by 0.9% between 2010 and 2014, it is difficult to be able to sustain retirement pensions in which new registrations are 35% more expensive than retirements (average pension of €1,310.1 per month compared to €966.70 for pensioners who retire due to death).

In conclusion, the forthcoming changes will try to contain spending, and it is likely that the Social Security income via taxes will be increased. We will see if these changes produce the inconveniences that the last reforms have already produced.

If you want to get this information weekly, follow us on Facebook or Twitter, and if you prefer to receive personalized attention, our Savings and Investment Department will be happy to assist you. We have the best savings products that insurance companies can offer.