Death insurance, popularly known as “death insurance”, is very widespread in our country. Spain has more than 20 million people insured, having covered in this way the funeral service. The doubt is in what type of premium (or policies) we should hire. Here we explain it to you.

But before determining which is better, let’s learn the definition of the natural premium and the level premium, the two most common types of insurance when it comes to funeral insurance.

What is the level premium?

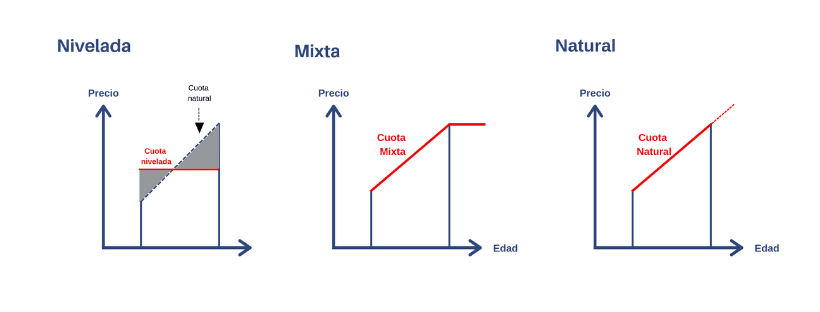

The level premium is the type of policy in which while you are young you pay more than what you would pay in the natural premium, but when you get older you pay much less than the natural premium.

The reason is that the factor by which the premium rises year by year is not the increase in age, but only the possible increase in the value of the service. That is, the CPI of the cost of the funeral service.

Taking out funeral insurance in this mode is especially interesting from the age of 55-60 years old. Before that, we believe it is more advisable to take out what is known as the mixed modality.

What is the natural bonus?

The natural premium rises year on year due to two factors:

- Age: the older the age, the higher the applicable rate and, therefore, the higher the premium.

- The service value: every few years usually rises, and is another reason for the natural premium to increase.

As we can see, we have two different options at our disposal, each with its advantages and disadvantages:

- In the level premium we will see that when we are young we pay more, but when we are 70 years old and older we will pay much less than in the natural premium option, since the premium is much more constant.

- In the natural premium, on the other hand, when we are young we pay less, but as we advance in age we will see that the increase is notable; even more, if we are lucky enough to live to 85-90 years of age.

The keys to funeral insurance

Funeral insurance covers the costs of administrative procedures, transfer of the body, burial costs (also if cremation is desired), etc.

Increasingly, we see a number of additional and complementary guarantees (e.g. dental insurance). In this post from a few months ago, we explained our opinion on these services, as well as the advantages of funeral insurance for its policyholders. In addition, we looked at the virtues of the insurance policies that are being marketed now compared to others that may have been subscribed for a long time.

We will begin by explaining what factors influence the price of a funeral insurance policy:

- The age of contracting: it is not the same to start with insurance at birth, as is typical in many families, as it is to start at 60 years of age. The company values the fact of having been insured all that time, and the cost changes (technically, one could say that the rate is not the same).

- The service value: this is the cost for the company to meet all the expenses associated with a funeral. People are surprised when they see 3,000 €, instead of 5,000-6,000 €; but for a company it is much cheaper than for an individual; since it pays for thousands of services per year. This variable changes according to the province, and year by year it increases, as does the CPI.

What about the“mixed” premium?

So far we have focused on natural and level premium. But there are drawbacks to both. In an attempt to alleviate this problem, some companies have come up with what is known as the “mixed premium”. “mixed premium”, which:

- It has the advantages of the natural premium: we pay considerably less than the level premium when we are young.

- When we reach the age of 60-65, it becomes a level premium. level premium to avoid the terrible situation of not being able to pay the insurance premium when we reach 75-80 years of age (as has happened in some cases of having the natural premium).

From PIB Group Iberia we work with the main funeral insurance companies. If you want us to inform you about which companies offer this type of death insurance policy with mixed premium, or you just want to review your current insurance, please contact us.